2024 is the year of making money!

Or giving it away.

So far, there has been a massive amount more outgoing than incoming, but I hope that next month I will be able to get back on track and break even. However, I am also looking to be more active teaching my daughter, Smallsteps, about money, money flow, value, saving, spending, needs, wants, delayed gratification... The list goes on.

And today, was the first day of her new life.

Payday.

This wrinkled 20 was the first allowance payment she has received. 20 sounds like a lot, but it is twenty a month, which my wife thinks is still too much. In my opinion, it is a bit like the army here, where the "pay" is enough to cover a packet of cigarettes a day. However, since my daughter isn't much of a smoker, I decided it should be enough to cover a bag of candy, and a soda.

She barely eats candy. Never had soda.

My thinking is that she should be able to cover something with it, if she needs. But, I also wanted to make it monthly for other reasons.

1) Larger amount

Having it as a larger amount means that it is harder to spend, because it seems more significant. Getting money in dribs and drabs (weekly) means that you can constantly spend, but can't get very much. Having the amount be more significant, means that she can also get something more significant.

2) Having to wait

Patience is a virtue, especially when it comes to personal finance and investing. The general level of patience these days seems incredibly low, which combines with a very short attention span to utterly destroy the chances of building an investment mindset. Smallsteps is going to have to do her various tasks and net get "rewarded" for them for up to four weeks. She has to invest her current actions, for a future gain.

3) Greater impact

Getting more all at once, also means that she sees that bump in her piggybank. She got the piggybank for Christmas (a large, fluffy pig), and she is only now starting to use it. We counted up all the money she had, including all the shrapnel (coins), so she knows how much is in there. This took us a little while, as it was a teaching moment for counting, grouping, and having some fun. Now, when she gets some money for her allowance next month, it is going to make an impact on the total. It is going up be tens, not by singles.

Now, Smallsteps doesn't really need money, and we don't expect her to pay for much, but having some money that comes on a schedule, means that she has some stability. The monthly schedule is used (my wife wanted weekly at first), because I get paid monthly. My theory is that the people who get paid weekly, probably struggle with money more than those who get paid every fortnight or monthly, as they don't have to manage their money as closely, because they are never "that far" away from a payday. I want Smallsteps to recognize that a month can be a long time, even though she is a little too young to learn the lesson yet, but we are going slow.

But as she doesn't need money most of the time, we are going to have to engineer some opportunities for her to spend some, as well as opportunities to not have enough to cover what she wanted. We have done this already, starting last summer at the zoo, where she wanted to buy two, small, soft toys from the giftshop, but only had enough money for one.

I made her decide.

In the end, she made the tough decision, but asked to have a photo with the one she was leaving behind, so she wouldn't forget it. She wasn't upset at having to make the choice, she was sad for the one that would miss out on coming home with us. Five minutes later, a typical then six year old, was happily playing with her new toy.

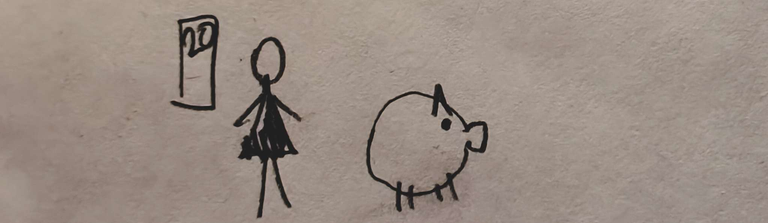

And today, I drew a diagram and told a story of how money flows, even when there "is no money", because she was interested to know. The other day I told how I got on the bus for free, because the card machine was broken and I didn't have cash. Smallsteps then asked if using the card means that the money isn't lost.

So, the diagram was of my work, a few banks, a shop, a bus, an ATM, and Smallsteps. I showed how I work for money, but don't get paid in cash. Instead, I have a bank account, as does my work, and then we played a game of working, getting paid, shopping, going on a bus ride, getting cash out of an ATM and crediting and debiting along the way. Smallsteps was doing the math of 10 from here to there, 2 from there to here, and so on. Eventually, I took twenty out of the ATM and gave it to her, where she deposited it in her drawing of her piggy bank.

While all this is very basic, going through the processes, drawing the pictures, talking it through, having her do the math, joking about different things and, setting up scenarios like "buying too many puppies (her story) and not having enough money to pay for food", help her to get an understanding of the flows and hopefully, take away a lot of the stigma that is set up around money in society. At least, I want her to be able to speak openly to me about it.

After she went to bed, my wife and I paid the bills that have been mounting up as we have been forced to front a lot of additional expenses. Looking at my bank account a day after payday and thinking, a month is a long time, is a reminder that I need to be better with my finances also.

Perhaps I should draw more diagrams.

Taraz

[ Gen1: Hive ]