Hi everybody!

We have recently traveled around Eastern Europe, crossed a few country borders and on our way, we did some grocery shopping. We noticed though, that the VAT rates were printed only on some of the receipts in Greece.

Also, only within a few tens of miles, there were quite big price differences, even when it was about similar things, mostly food.

That got us thinking, why is that? Some of the countries, like Greece, Bulgaria and Romania and all members of the European Union, so probably they should have the same VAT rates?

VAT stands for Value Added Tax

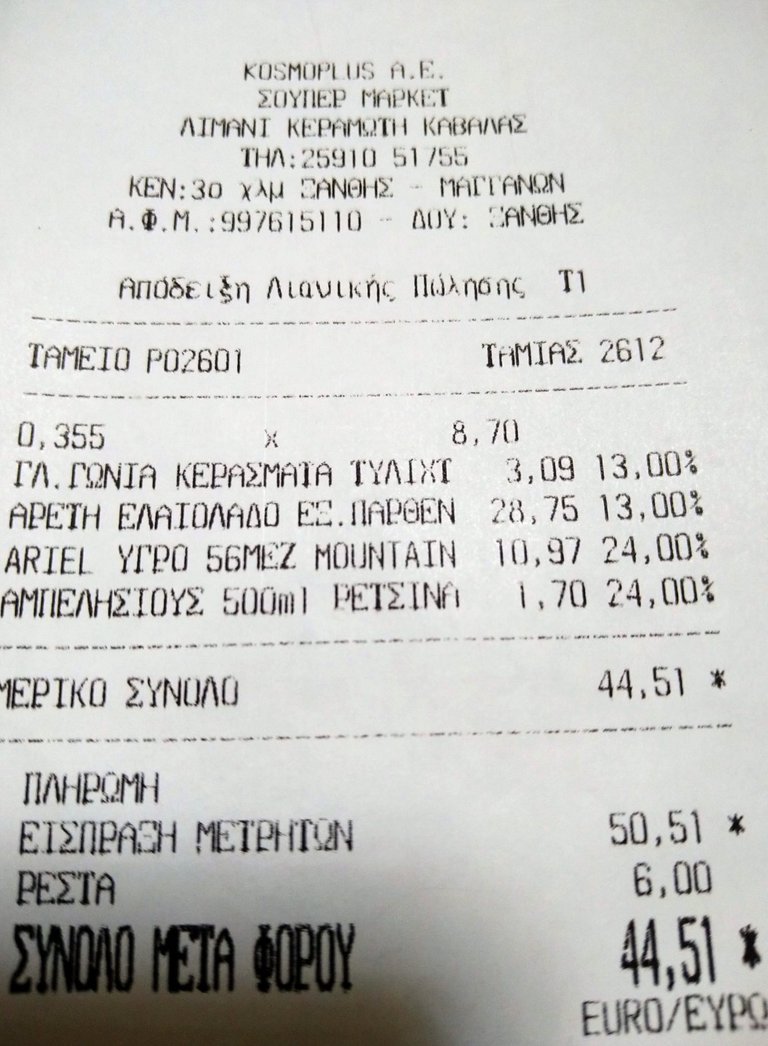

Here is the receipt we got from a Greek supermarket. The VAT rate is imprinted at the end of each line. The first two lines are food related with 13% VAT. The third line is of a washing detergent and the last, fourth line is a bottle of a specific local wine, called "Retsina", that we highly recommend :)

Again, 24% VAT.

So after some research and asking around, below is a table, in Alphabetical order, that's just compiled out of our research, first-person experience and some online sources, found later.

Let's also note, that there are particular items with 0% VAT rate in those five countries we've checked. Like "Intra-community and international air and sea transport", or bread and flour in Bulgaria, but that last one is rather an exception, as it has been implemented only a few months ago.

The most interesting and question-raising parts however, are, what goods fall under the reduced rates and thus the particular states tax less.

| Country | Standard VAT rate | Reduced VAT rate |

|---|---|---|

| Bulgaria | 20% | 9% |

| Greece | 24% | 13% or 6% |

| Romania | 19% | 9% or 5% |

| Serbia | 20% | 10% |

| Turkey | 18% | 8% or 1% |

A first glance would read, hey, the differences are not that big, right?

Moreover, let's note that Serbia and Turkey are not members of EU.

However, to our deep and sincere surprise, there is one HUGE difference.

We all know the food is the basic need of any human being.

The food VAT rates for all those countries, except for Bulgaria, fall under the "Reduced rate". Thus, all other citizens, apart from Bulgarians, pay food VAT in the range of 8-13% while Bulgarians pay 20%.

Is it a cultural aspect?

Is it because Bulgarians are rich?

Contrary, Bulgaria is known to be the poorest country in the European Union.

Don't you find that very strange?

Or this angle just explains, or is one of the reasons for that fact?

Here are sources we've used in particular:

Bulgaria: https://www.avalara.com/vatlive/en/country-guides/europe/bulgaria/bulgarian-vat-rates.html

Greece: https://www.avalara.com/vatlive/en/country-guides/europe/greece/greek-vat-rates.html

Romania: https://www.avalara.com/vatlive/en/country-guides/europe/romania/romanian-vat-rates.html

Serbia: https://www.vatupdate.com/2021/04/18/vat-rates-in-serbia/

Turkey: https://www.orbitax.com/news/archive.php/Turkey-Adjusts-VAT-Rates-on-Va-49483