When it comes to crypto there's no shortage of options to now select from. But there are now two that stand out above the rest and those are $BTC (Bitcoin) and $ETH (Ethereum)

Bitcoin has primarily taken the stance of being a store of value and really doesn't update their code ever which is a good thing because it's battle tested and strong.

Ethereum on the other hand is what's given us all of these "extras" from NFT's, gaming, smart contracts and more Ethereum has been the one factor to really expand the ecosystem of which everyone else seems to just pull off from.

That being said I want to take a moment today and jump into each a little deeper.

BTC

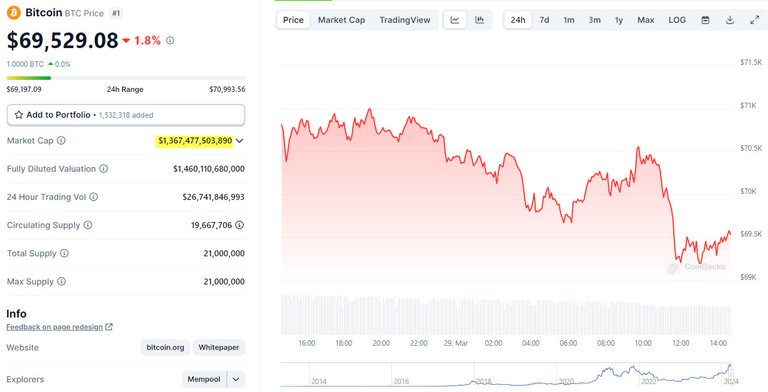

At the time of writing this bitcoin has been holding around that $70,000 mark with a massive 1.3 trillion dollar market cap. That might seem like a lot but when you factor in the trillions of dollars that bitcoin now has access to it pails in comparison.

In fact it's now expected for at least 1 trillion dollars to enter the bitcoin market cap this year through investors 401ks and large investors who still seem to have most of their money sitting out of the game.

Another trillion dollars into bitcoin will push us at around $114,000 pretty much that ATH I've been called for since the end of the last bull run. I'm curious to put that prediction into play this cycle and see how it does.

A lot of price action happened on bitcoin through simple speculation that a ETF would be approved for bitcoin. I mean when It finally got approved in early 2024 I'll admit I was a little shocked and figured the SEC was going to beat this thing longer.

But I guess when you have control of most of the worlds money (aka blackrock) well you're the one that actully gets to call the shots.

It's expected that this inflow of money will only push bitcoin to new ATH much like we see in the stock market. While there are retreats and random things that happen over time the price of the S&P500 only goes up and that's also now expected for bitcoin.

Ethereum

Once Bitcoin got it's ETF approval it was only logical that the new silver standard to gold Ethereum would be next in line. (Side note the silver standard for bitcoin was Litecoin for many years until Ethereum started to take root)

Ethereum has a number of current ETF's in the pipeline but are being blocked just like bitcoin was by the SEC as they try and figure out if this thing is a security or not. I have a feeling that Ethereum is simply too large now that the powers that be will force the SEC to approve the ETF or some form of it that would make it flow into the rules. You see whenever there's enough money involved there's always a way. I mean hell look at Sam who scammed billions of dollars now only gets 25 year behind bars which will most likely be reduced.

Fideity is currently leading the punch with a Form S-1 Registration statement. It would allow Fidelity to act as a custodian of the trusts's ETH in which it will stake a portion of the ETH that are bought off of it's ETFs. Which makes sense, this is what banks do all the time with your money. They take 90% of it and loan it out to other people while giving you legit crap.

With this new form it could mean that those buying Ethereum would earn some type of dividend yield on the ETF. *Which would be lower than that earned from the staking of the rewards since for one all of it would not be staked and two they need to make some form of profit.

Coinbase does this already by adjusting their APR on Ethereum. Right now it pays a 2.74% yield but normal operation would be around 3.5%. Throw in some wild fees on top of that and you can see just how much can be earned from these large players in terms of passiveish revenue from blockchains.

Posted Using InLeo Alpha