Issuers of spot bitcoin-ETFs have received 3.07% of the 21 million bitcoins ever available for issuance under management. According to the latest data posted on the websites of companies that have launched new bitcoin exchange-traded funds, the firms manage more than 645,000 BTC.

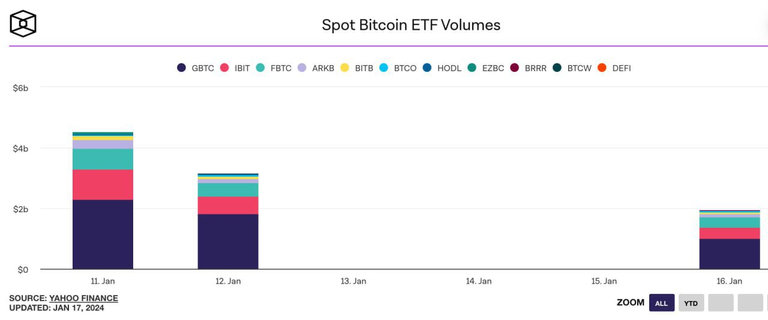

Trading volume in shares of the 11 bitcoin spot exchange-traded funds (ETFs) launched in January approached the $10bn mark in three days, according to James Steffart, ETF market analyst at Bloomberg. As his colleague Eric Balchunas specified, this transaction volume in new bitcoin funds exceeded the turnover of 500 ETFs for other assets launched in 2023.

According to Balchunas, these are "insane" numbers. All 500 2023 other-asset exchange-traded funds combined saw $450 million in trading volume during the 16 January trading session, the largest of which was $45 million.

For comparison, the bitcoin-ETF from Grayscale alone had a transaction volume approaching $5 billion in the three days since the start of trading, the fund from BlackRock - $2 billion, Fidelity Investments - $1.5 billion. All of these figures are really formed by market action and cannot be inflated, Balchunas said separately.

The bitcoin (BTC) exchange rate, meanwhile, has not been subject to noticeable volatility for several days now. After falling at the end of last week, the price of the first cryptocurrency has consolidated at $42.6 thousand.

And if we take into account the general trend of bitcoin price movement, the price has fallen by almost 10% since the launch of the ETF.

It is unclear where and how the said funds bought bitcoin, but it is absolutely certain that no centralised exchanges received $10bn to buy bitcoin. But live bitcoins were actually coming from large wallets on Coinbase, Binance and Bitfinex including Mike Saylor's Microstrategy wallet.

In normal life, each Tether issuance of just one billion resulted in a 3-5% increase in the price of BTC. In our case, as much as $10 billion has come into the market, and the price is going down. Garry Gensler was right when he said that he doesn't understand the general euphoria of the launch of exchange-traded bitcoin-ETFs. It's flooding the market, the real influence on the price of the first cryptocurrency, with perfect worthless paper bitcoin surrogates.

Another phase of curbing market influence on the price of the first cryptocurrency, following the launch of exchange-traded bitcoin futures on the CME. Now, as paper bitcoin floods the market, BTC price can be sent anywhere if desired. Easily and effortlessly .

In the first day and work of bitcoin ETFs on centralised exchanges was a big haymaker. The amount of liquidations amounted to $313 million. ETF optimists, i.e. longs for $257 million and shorts for $55 million, were liquidated mostly.

This Pyrrhic victory in the real market led to the collapse of the bitcoin price. Bitcoin is currently trading at $40852. You can rejoice endlessly at the approval of the new 11 bitcoin ETFs, but it is better to look at the history of silver prices since 2011, when its surrogates in the form of exchange traded ETFs appeared on the market instead of the live metal. The price of silver has plunged 65% in 13 years.

Thank you for being here and reading to the end!

Posted Using InLeo Alpha