Tax filing is the annual activity that is required to be done by 31st July for salaried employees in India. Sometimes this last day can be extended on public demand but in the last few years there has been no extension hence it is always good to follow the deadline and file the taxes before the date. Generally, a lot of people file their taxes when the due date approaches but I think that is not the right time because sometimes things can be difficult and even the website creates issues due to heavy load in the last week of filing. I generally complete my filing in mid of July and I have done my job for the year.

Form 16 is issued by the employers for salaried employees in May or June month. I received my form 16 in June month and just after the form was received filing can be done but I did not do it in June. I completed my filing last week but it was not so easy this time because I had to file a different form. ITR 1 is required to be filed if income is primarily from salary and this is the easiest form. Very little information is required to be entered in this form and I think it does not take more than ten minutes in any case to get the filing done. This is why I say that ITR is the simplest and easiest form of tax filing.

In the case of Crypto which is considered as VDA in India, ITR cannot be filed. The person has to go with ITR 2 or ITR 3 depending upon the income. If the person is earning income through the business then ITR 3 is required else ITR 2 is good to go and since I did the filing through form 2. Its not an easy form I would say because its a lengthy form and there is a lot of information that needs to be filled in. I had filed the same form last year as well after going through a lot of videos and reading the article but this time again I had to go through multiple articles and videos. Last year I also got the notice from the government for some clarification which I was able to answer by myself and the case was settled in January. I had to pay some extra amount because there was more crypto selling and as per them my calculation was not correct so I paid the remainder amount and this is how the filing was completed for the last year.

This year first I thought of taking assistance and I inquired with some of the websites but then I realised that their charges were too high. I had so many transactions for crypto last year but this year there were very few and less than 10. The amount they were asking me to pay was not reasonable so I thought of doing it by myself. It took me almost a day to go through the latest updates and whatever was there and then I completed it. There are so many 3rd party websites offering the filing services but I don't rely on them because there is no surety how they are going to handle the data and since this information is quite sensitive. Although they are charging and most of these websites are charging pretty much a high amount clear Tax is one of the websites that was offering me a reasonable amount. I was OK with the charges but again the concern was that I was putting my information on a 3rd party website and I have no control over that because if they misuse the information then it can be a problem for me.

My preference is always to use the government portal for tax filing because I do not feel comfortable sharing my sensitive information with a private entity. Although the form created by the income tax department is complicated and it takes a lot of time to understand what information needs to be entered but its fine because after the exercise for one day, I could do this on my own. I am happy that my information is not shared with any 3rd party and also I can do it myself so there are no charges that I need to pay. I was even looking for some assistance but surprisingly those people were charging much more and I find it quite on the higher side so I changed my mind and did it by myself.

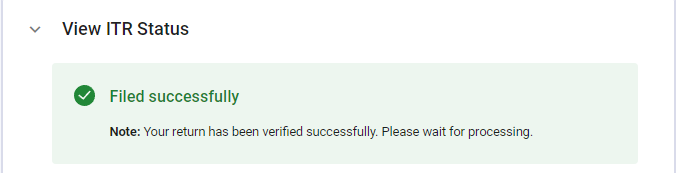

I realised that these people charge according to the form type and when it comes to ITR form 2 or 3 then their charges are very high since they have a mindset that whoever is filing through this form must be earning a big amount which may not be true in all cases. In my case, I had some crypto sale transactions but unfortunately, I was at a loss because the coins I sold were purchased a long back I was in lost so there was no tax payable. Primarily salary is the only income which was required to be filled where tax is already paid. After a lot of struggles finally, the activity was done for the year from my side and now I'm happy that there is nothing required from my side and waiting for the final processing from the income tax department which should happen soon.

Thank you

Posted Using InLeo Alpha