Hello!

In the yesterday post I explained I took a position in the Meteora's Dynamic Liquidity Market Maker (DLMM). Concretely in the pool of TRUMP-SOL to try to farm rewards and volatility.

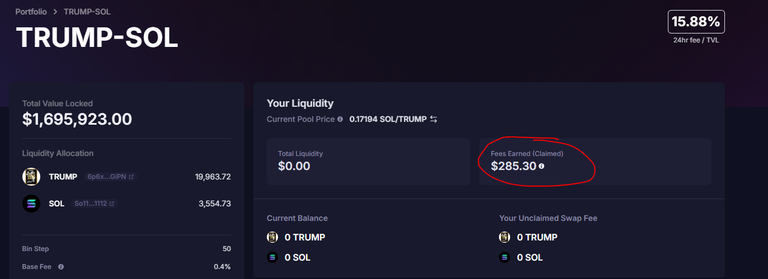

I deposited 5.9 SOL or $1,500 approximately. As you can see in the above image I earned 285$ in fees in just 24 hours with just 1,5k of liquidity. That is a 19% for just 24 hours. I don't know how big the APY number would be if calculated but it would be extremely big.

The markets took a hit since I entered, SOLANA and TRUMP both went down and I've ended with approx $1,350 usd. So a total loss of $150. However if we look at the SOL loss I went from 5.9 SOL to 5.7 SOL which is a very unsignificant loss. Almost all the loss in dollar value has come because SOL went down. So I'm quite happy with the experiment.

I've learnt a lot about DLMM and I watched a bunch of videos with different strategies. I will put more liquidity if Bitcoin goes higher, I will take safer approached but I will be testing different strategies maybe with the SOL-USDC pool or even JLP-SOL pool which are safer options in my opinion.

I hope you had a great day!

Posted Using INLEO