I realized recently that I have become a bit of a Hive maxi or rather that I was caught up in the Hive bubble and more or less ignored what was happening in the broader crypto world. This made me think and I decided that I wanted to continue following things and learn stuff. That is why I started my first excursion into the Solana land. The reason why I chose Solana as a first destination was because it seemed to have the most Fomo at the moment. It's probably not the best reason I have to admit.

Searching and discovering

I tried to go through Solana with a very open mind and I probably looked at close to 20 dapps in the ecosystem. This is probably only a small sample of all that is available on Solana but I like to share my findings here with you and also write them down for myself for the future.

It's not easy to know where to start in a new environment and I tend to start with the most prominent services. On the Solana website you find a whole list of dapps that are available in the ecosystem and I simply checked the most visible ones. I mainly dove into the dapps that are allowing to generate a return... Return seeking seems to be in my bones... and of course I landed into the Defi sector.

Concentrated liquidity pools on Orca

I checked several of these dapps and finally landed on Orca. Together with Jupiter these two platforms are referred almost on all the other defi platforms on Solana. Jupiter is great for trading and Orca is great for providing liquidity.

What is different about concentrated liquidity pools?

You probably are aware what a liquidity pool is. So I won't go into details to explain that. I will rather try to explain what sets concentrated liquidity pools a part.

When you go into the liquidity tab on Orca, you will find plenty of trading pairs and you can sort them according to the tokens that you want to pair. What is interesting, is that there several pools with the same pair but with different Fee rates. I was wondering what the reason for that was and I think that there are different liquidity pools for a same pair which allows arbitrage among the pools.

What is also interesting is that the Yield of the pools is expressed in percentage per 24 hours. I found out that these rates are changing very quickly. Also these rates are composed of trading fees and sometimes rewards. These are interesting differences but they are by far not the main ones...

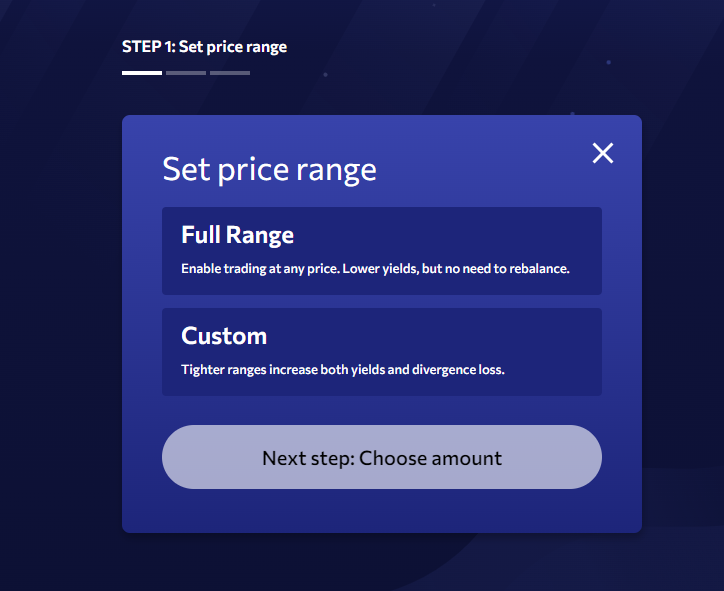

Choose your leverage

When you decide to provide liquidity for a pair, you can opt for the full range or the custom range. When you opt for the full range, then your experience will not differ from what you know from any other liquidity pool. If you however chose the Custom option, then things are totally different.

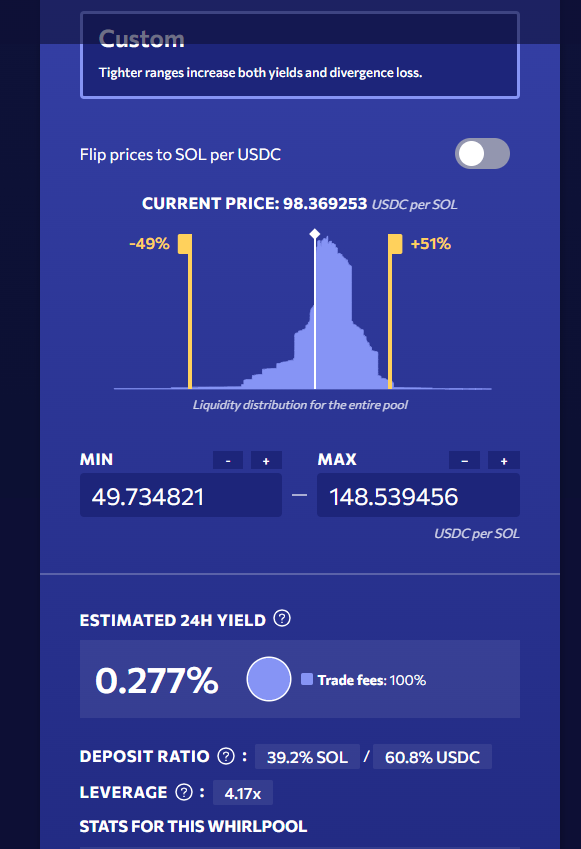

You can set the range in which you want to provide liquidity. You can set a minimum and a maximum price. You can even set these prices asymetrically. Meaning that the percentage of liquidity is different. You can for example make sure that you provide only 30% of token A and 70% of token B. The more you close the limits of the range, the more leverage your position will have.

By leveraging your position in the pool, you will earn a bigger yield but you will also have bigger exposure to impermanent loss.

What happens when you are out of range?

If the price of your liquidity position drops out of range, your position will not generate any return anymore and also you will only hold one of both tokens, according to which side the price broke out of your range.

You can decide to keep your position open until it gets back into range or you can terminate it and you will get only one of the tokens.

Is it worth to customize your position?

I have played around with these customized ranges and I have to admit that I lost more money that I earned. I made the mistake to leverage my position too much (up to 10'000% APR) and it came out of range and I was left with a shit token... Thanks to the small transaction costs on Solana, it's possible to play with small amounts so I lost only a couple of bucks.

I have to say that such customized positions can be pretty interesting if you are willing to have one or the other token anyways. It can be a way to hedge your position.

Let's say I pair SOL with a stable coin like USDC or USDT. If the price of SOL doesn't move much, I will earn yield from providing liquidity. If SOL explodes, I will get a lot of stable coins. It's like selling SOL when prices are high or DCA out of SOL when value goes up. If SOL goes down, I will end up with a lot of SOL. It's like DCA into SOL when prices are low. So if I'm willing to have either coin, then I think such concentrated liquidity pools can make a lot of sense.

What I would suggest is to avoid the pools with huge yields because they often pair a shitcoin together with a more stable one. You will almost always end up with a lot of impermanent loss. The generated yield won't be able to cover that in most of the cases. As always this is for educational purpose only, this is no financial advise and I encourage to do your own research.

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes:

-

-