Ready to jump?

The Reserve Bank of Australia finally broken their promise of not raising interest rates until 2023 and lifted them by a quarter percent, 25 basis points. This is the first rise in 11 years in Australia, but it isn't going to be the last in the near term and, the big banks have followed suit and passed it onto their customers, as they do.

All those people who over the last two years have been swept up into the FOMO of buying a house at a premium, pushing their mortgages to the max, taking loans from parents and injecting all they have and more in - must be getting a little nervous.

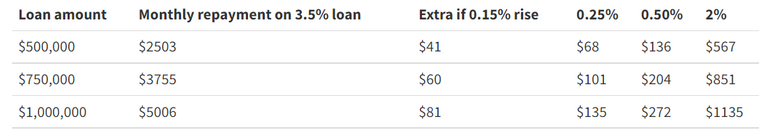

As you can see, the monthly extra can stack up pretty fast and if you think that a million dollar loan amount is massive (it is) it is also the average house price in the Sydney area, so not uncommon at all. A 0.15% interest rate is bearable, but even at 2% that is looking at becoming 2 months average salary before tax and, this is before factoring in that it isn't only loans going up, the cost of everything is going up.

Just remember, negative interest rates are awesome and printing money doesn't cause inflation.

Feeling rich?

It is interesting to think though, that while so many people are so scared of loss that they can't put a few dollars into crypto, the same people are also quite happy to drop 15 years of salary into a house, after it has already increased 25% in the last year. That is a difference of 3 and a half years of full salary - insanity?

Well, we all need a place to live, but it still raises the question of what is considered valuable, what we need to live, what we think is going to be worth our time, money and potential to lose it all.

As I was saying the other day about my friend who dropped 1000€ on BTC and watches it daily, that amount represents around 0.2% of the value of his house - which he has a loan on. The ceiling hanging from the vaulted ceilings is worth more, yet there he is, watching the price of Bitcoin fluctuate, worrying about whether he is up 200 euros or down 500.

So, what is valuable?

Is it where we spend our money, where we spend our time, or the things that hold our attention and make us worry?

I don't know and for each of us, the profile is likely different, but I do think that we each need to reflect on what we as an individual feels is worth paying a price for. For many at this point, the wise play might be to put a small percentage of earnings into crypto just in case, but a small percentage of what? Just think, someone buying a million dollar house in Sydney today, is paying 200 thousand more than they would have a year ago - that is an incredible amount of money if thinking about it in terms of an investment and it is almost half of what a retiree would need to have at 65 in their superannuation. But, spending that extra in the space of a year seems justified somehow.

Interestingly, the expectation on house prices could see them drop 30% in value over the next couple years, which means that not only did people pay 200K extra in the space of 12 months, but if it happens, they will end up paying another 100K extra on top due to the loss on their property value, plus interest.

But hey, they have a house!

We each make our decisions in this life, but it is interesting to contrast our decisions against other decisions we make, buy & sell, love & hate, happy & sad - and each choice we make, is going to take other choices off our table and we hope that at the end of the day - we have a better life than bad.

In my estimation, it is important to talk about these things, but at the same time, we shouldn't get so caught up in them that we get lost, no longer able to tell what is valuable to fight for, and what just isn't worth it. A house and a home are two different things, yet they'd have you believe that buying the first, gives you the second.

People are often overpaying for a house, at the cost of owning a home.

Taraz

[ Gen1: Hive ]

Posted Using LeoFinance Beta