Finally dropping rates

The United Kingdom has witnessed a significant decline in its inflation rate, a development that has caught the attention of economists and policymakers alike. After a period of high inflation driven by factors such as supply chain disruptions and soaring energy prices, recent data indicates a steady easing of inflationary pressures. This positive trend is largely attributed to stabilizing global markets and improved domestic economic policies. As a result, the International Monetary Fund (IMF) has expressed its optimism, proposing that the Bank of England should consider lowering interest rates to 3.5% by the end of 2025.

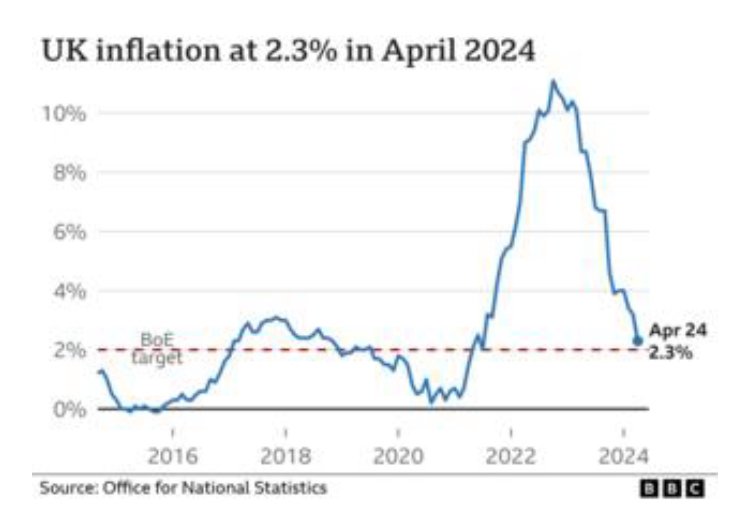

Decline in Inflation Rate

In recent months, the UK's inflation rate has shown a marked decrease. The Office for National Statistics (ONS) reported that the Consumer Price Index (CPI) inflation fell from its peak of 10.1% in July 2022 to 5.2% in April 2024. This drop is primarily due to the reduction in energy prices and a more balanced supply-demand dynamic post-pandemic. Additionally, the resolution of Brexit-related trade disruptions has facilitated smoother business operations, contributing to the overall price stability.

IMF's Recommendations

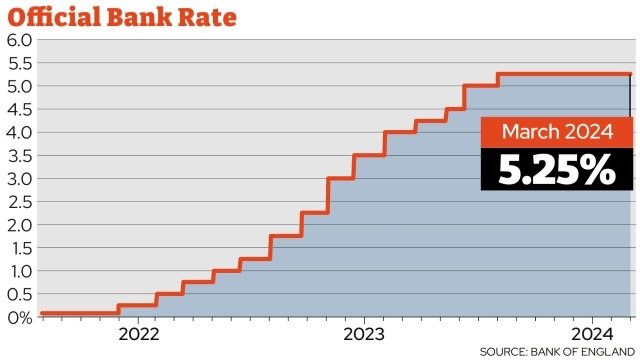

The IMF has closely monitored these developments and, in its latest report, recommended a strategic reduction in interest rates. The Fund suggests that if the inflation rate continues its downward trajectory, the Bank of England should target an interest rate of 3.5% by the end of 2025. The IMF's recommendation is grounded in the belief that lower interest rates would stimulate economic growth by reducing borrowing costs for consumers and businesses, thereby encouraging spending and investments.

Economic Implications

Lowering interest rates can have multiple positive effects on the economy. For households, reduced mortgage rates and cheaper loans could increase disposable income, boosting consumer spending. For businesses, lower interest rates can ease the cost of financing expansions and new projects, fostering innovation and job creation. Moreover, a balanced approach to rate cuts can help maintain financial stability while supporting economic growth.

However, the IMF also cautions that the Bank of England should proceed with vigilance. While the prospect of lower interest rates is appealing, it is essential to ensure that inflation does not rebound unexpectedly. The central bank must closely monitor economic indicators and be ready to adjust its policies to maintain price stability.

Conclusion

The UK's declining inflation rate presents a promising outlook for the nation's economy. The IMF's suggestion to lower interest rates to 3.5% by the end of 2025 aligns with this positive trend, aiming to stimulate growth and improve economic conditions. As the UK navigates this new economic landscape, careful policy implementation will be crucial to sustaining long-term stability and prosperity. The coming years will be pivotal in shaping the UK's economic trajectory, with the potential for significant gains if the balance between growth and inflation control is effectively managed.

Sincerely,

Pele23