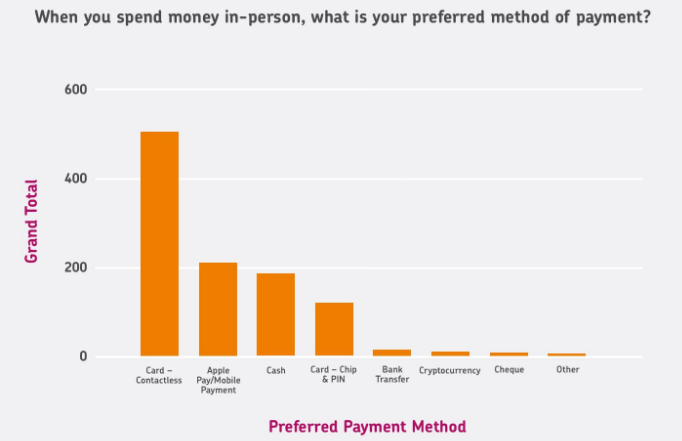

The global pandemic in 2020 significantly increased the popularity and acceptance of non-cash payments. People were forced to use digital payments in lieu of cash due to the pandemic. We also discovered that digital payment is more convenient.

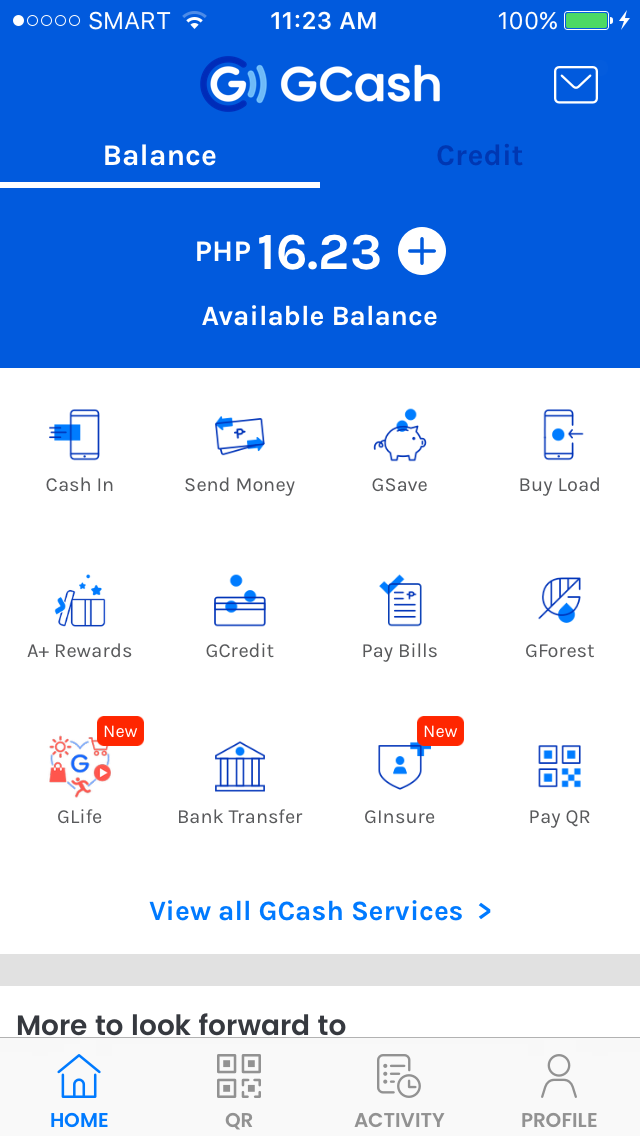

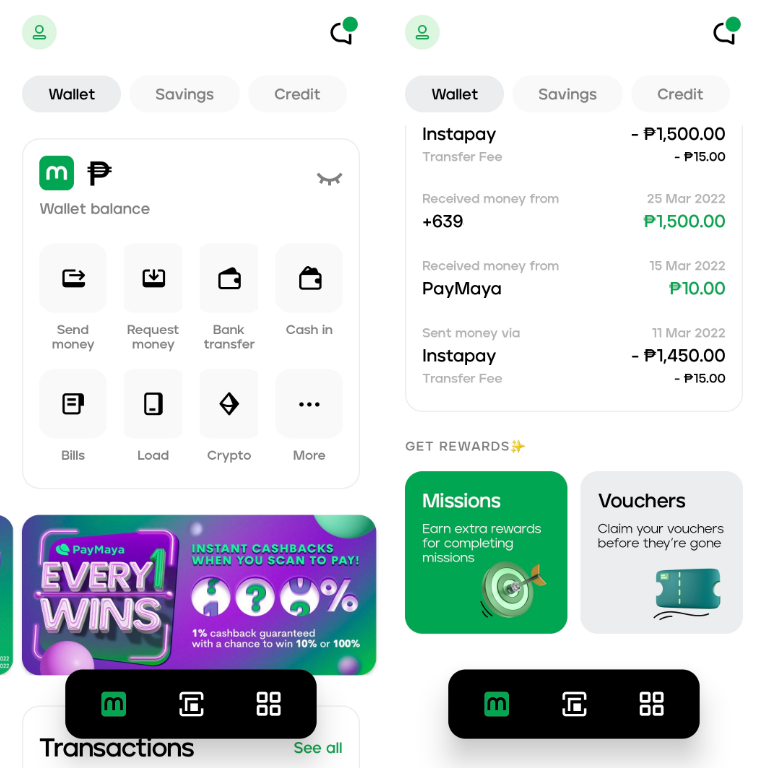

Cash as a mode of payment has been declining. In our country, fintech apps like GCash and Maya are accepted modes of payment in shopping malls, grocery and transportation. Covid-19 accelerated the use of these fintech apps since then.

Another mode of digital payment is CBDC or Central Bank Digital Currencies. While advanced economies like the US and Europe are taking their time, others are leading the CBDC race. China for example is pushing for the digital yuan and is believed to be ahead in the race for cashless society.

Lastly, cryptocurrencies. The 2008 financial crisis resulted in the start of Bitcoin and cryptocurrencies as payment methods. While adoption is somewhat slow, countries and companies are recognizing the importance of crypto. We have seen a number of funds and governments disclose their investments in BTC and BTC ETF. Recently companies like Visa, Mastercard and Paypal are in the news embracing crypto. In our own Hive world, there are some countries that accept HBD or Hive Backed Dollar as payment and as our platform grow, we can expect the adoption to increase as well.

Does this mean the end of cash? Cash is unlikely to disappear in the near future. Majority of individuals still rank cash as a preferred mode of payment. In Japan for example, I noticed that cash is still widely used in groceries, shopping malls and restaurants. They have prepaid cards that can be used in train stations and some vending machines but cash is still widely used.

Posted Using InLeo Alpha