Hello to all airdrop farmers, hunters, and degens across the globe!

It's crazy how many opportunities the airdrop farming scene is offering. New stuff keeps popping up many times a day if you follow certain channels and individuals. There just isn't time or money for everyone, so I have changed my strategy a bit and now try to focus on the ones that could make me eligible for multiple airdrops with a single deposit and little effort.

Mode blockchain is one of those. In this article, I will share some experience and insight on how to jump in and what kind of opportunities Mode has to offer.

Modular Decentralized Finance

Awarded a $6mil grant and powered by Optimism, Mode is an Ethereum L2 build on the OP stack meaning the fees are extremely low compared to the ETH mainnet.

That being said, to take part in the MODE token airdrop, each user has to bridge from the mainnet to Mode at least once. For me, the ETH fee was something close to $40 which indeed wasn't my cup of tea...😫

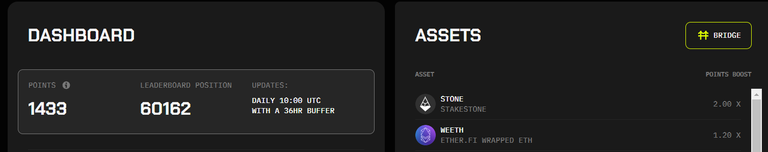

- 💡 PRO TIP: if you are someone like me and have multiple EVM wallets for different purposes, I'd suggest you login with each and test which one gives you the most points before bridging. I made the mistake of bridging with a wallet with fewer pre-points than my older wallet.

Once you have bridged ETH to Mode, you begin to accumulate points right away. Points are updated daily but there seems to be a 3-day buffer so they'll show up with a delay.

Let The Farming Begin!

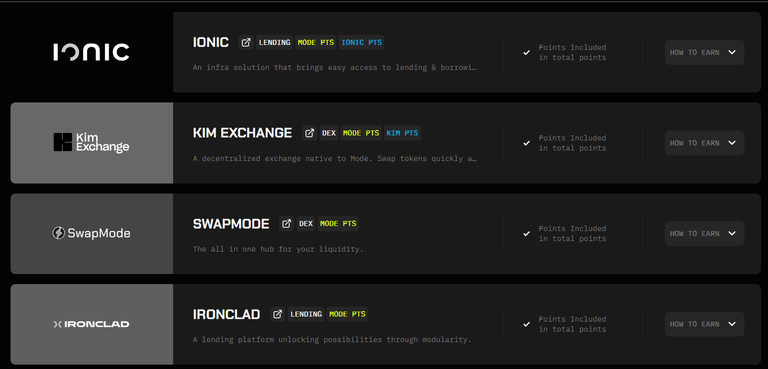

Here's where it gets interesting! There are already quite a lot of dapps on Mode and they all have different incentives to attract new users. You can leverage this and develop a strategy of your own and decide what to focus on.

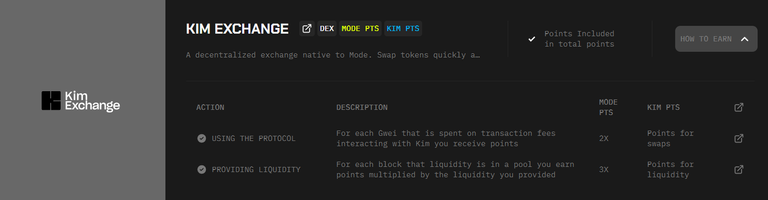

The main attraction most users are obviously after is the Mode airdrop points. The thing here is that different apps give different boosters and multipliers for Mode points. For example, providing liquidity on the Kim Exchange gives you 3x Mode points compared to SwapModes 2x.

Then again, the annual percentage rates (APR) can be much higher on SwapMode. For example, the ezETH-ETH pair on SwapMode gives you an APR of 30% - 92% and in comparison, Kim Exchanges APR for the same pair is only 1.94%.

There's also another factor to take into consideration - the dapp points.

Some dapps on Mode are running their own points program on the side and those points will most likely count toward an airdrop of their token when it's launched.

On the main page, you can see the dapps with their own points system marked in blue.

Even More Points

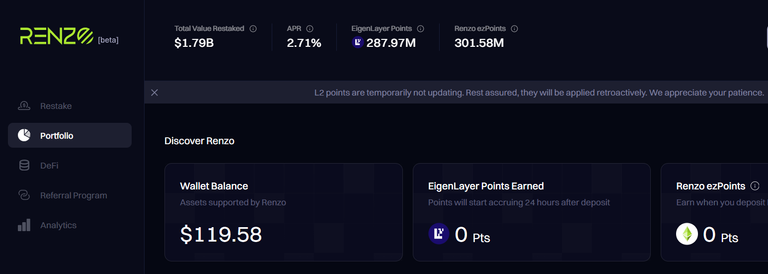

Before you go in depositing on Ionic or Kim, you should visit Renzo where you can restake your Mode ETH. In return you get Renzo native ezETH which will earn you Renzo points and EigenLayer points on top of Mode points.

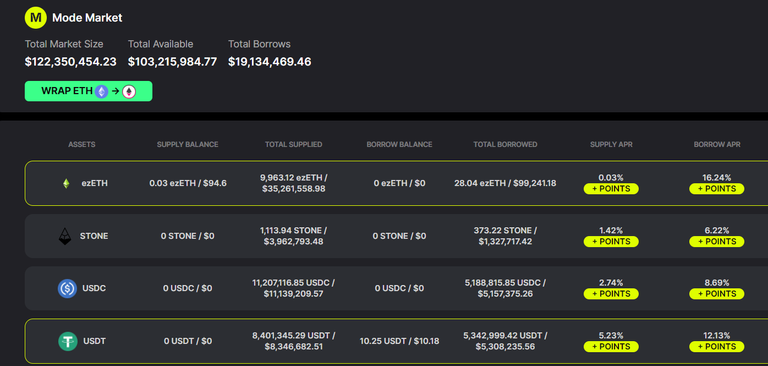

You can then make that ezETH work and for example supply liquidity on the Kim Exchange or lend it on Ionic and earn their points as well.

POINTS YOU'LL BE FARMING WITH THIS STRATEGY:

- Mode

- Renzo

- EigenLayer

- Ionic

The whole points system hasn't been completely revealed by the team and there might be some hidden criteria or upcoming campaigns that might have some weight too.

I would advise you to study the dapps a bit, take a tour on Mode, and find out what you can do with each one.

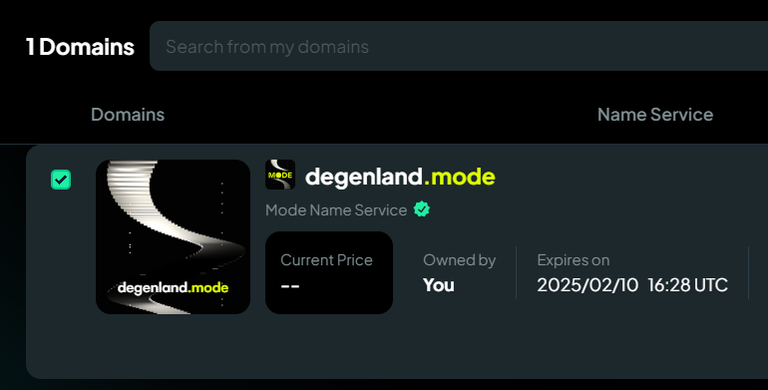

One bonus thing I did was to acquire a Mode domain using the Space ID name service. It cost about $10 and it has probably been counted in points but I believe it might still have some future use and value. For example, just today I read that holding one will increase the Web3 score Galxe.

Low Fees Allow Many Strategies

I have some of my Mode assets in stable positions and with those, I'm waiting for the next dip. My idea is to buy ETH, restake it with Renzo, lend it, wait for its price to increase, and borrow some stables using it as collateral, and buy some more ETH during the next dip.

Then again, while waiting for dips, things can rapidly change as they do in this crypto space and perhaps the best about Mode is the low fees. This allows smaller fish like myself to exit and re-enter positions when a new app launches on Mode and introduces some new incentives.

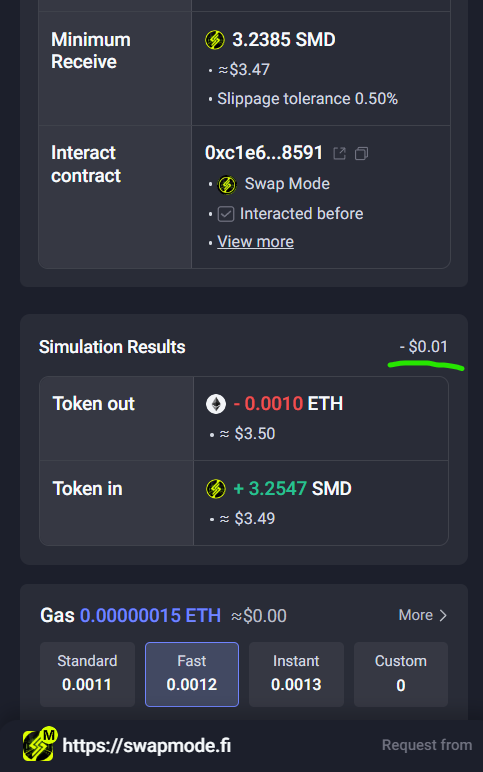

Here's an example of a small Mode swap waiting for approval on my Rabby Wallet:

Now imagine doing this on the Ethereum mainnet!

Mode was launched in January so is a pretty new chain with lots of new dapps and opportunities. When I was farming airdrop points on Ether.Fi I noticed they constantly introduced new ways to gather points but I couldn't take part as I was stuck with my stake position because of the high mainnet fees.

On Mode, if you have time and energy, you can easily strategize with a smaller deposit and move it around across dapps at a way smaller cost.

Conclusion

Not much has been revealed about the Mode airdrop and whether it's linear or not. Still, I believe this one is worth the time and bridging fee spent. With a little effort and research, you get exposure to multiple airdrops and besides, if you play the long play, Ethereum is a pretty solid bet.

It's good to keep in mind though that restaking always adds another layer of risk because there is more than one protocol involved. Therefore spreading your assets across many dapps could be a good idea.

All in all, I believe people are sleeping on Mode and especially on the dapp points & restaking points. I'm pretty sure that the $40 lost in ETH was just a drop in the ocean when the airdrops start dropping.

Lastly, you can see all the dapps I mentioned are more on the Mode airdrop page which makes it easy to navigate between them in the future if you decide to start using it. If you do, consider using my invite code: XGNHet (or use this link: Mode

Thank you for reading!

New Airdrops:

🔸 MilkyWay - stake TIA farm MilkyWay airdrop

🔸 Elys Network - easy 1 minute/day testnet

🔸 Grass - perhaps the easiest way to gain exposure for a potentially very big airdrop!

🔸 Tabi - easy tasks. Backed by Binance. Invite codes: zYvX3 , p5S2p , JOsHn

🔸 Archway - join the Archway airdrop waitlist

🔸 GRVT ZkSync Mystery Box - just log in and claim your first mystery box

🔸 Ether.fi - stake ETH for Points & EigenLayer points

🔸 Mode airdrop

Disclaimers:

Thumbnail background image made with Canva

This article contains referral links - remember to DYOR, and double-check URLs!

Posted Using InLeo Alpha