https://images.inleo.io/images/bitcoinflood_qzbuMNG6XdYQq0Cl.webp

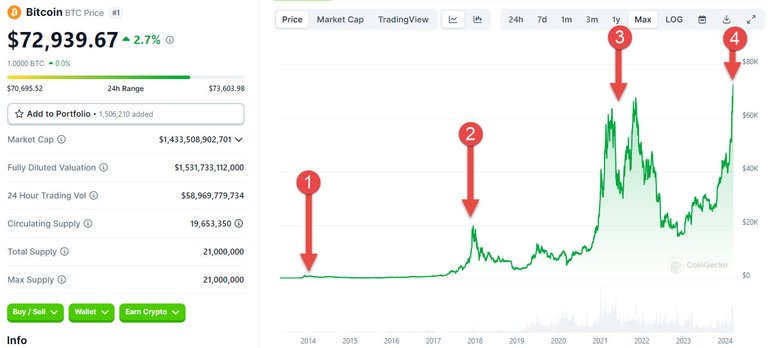

The time frame between bull runs might have felt long for us that have been in the game for a while but honestly this bear market was one of the shortest ones yet with some of the heaviest corrections.

Just a little over a year ago $BTC hit a low in the bear market around $16,000 per bitcoin. Fast forward to today and it now has shot up to over $73,000! A nearly 400% increase in just a little over a year. Personally I called the bull market last year when we started to move out of the 20k range and told others. The funny thing about the bull market is you don't realize you're in one until it's about at its peak.

This has also been the case for Ethereum. Touching $1,200 during the bear market and now quickly moving towards ATH's as it starts to breach $4,000 per token.

So what the heck is actully going on?

Let's take a dive into it and see what's been happening.

*This article is for entertainment purposes only and is not financial advice

Supply & Demand

No matter how much you want to complicate any asset it always comes down to the basics. The supply and the demand. Ethereum is currently burning more ETH then it's printing creating a reduced supply while demand for it continues to go up based on speculation of a possible ETF but also for other reasons.

Bitcoin is also going through a supply crunch as major corps and ETFs have launched and people are grabbing it up. There's already a liquidity shortage of the asset and the supply is about to dip in 30 days due to the bitcoin halving invent which will take the current 6.25 per block will be cut in halve.

This is cause a major run on the asset to grab it up and grab up as much as possible from people ALL over the world.

The Cycle

Just like the stock market has cycles bitcoin and crypto in general seems to have theirs as well. This cycle at least from what I've been able to tell has been shrinking and becoming faster. What was once 4 years from 2014 - 2018 went to 2018 - 2021 three years and this time around 2022 maybe end of 2021 to early 2024 has seen its next spike.

The State Of The World

Looking at the stock market we can see that Crypto normally follows a pretty steady path with the stock market in terms of bull runs. We also see other factors like war, tech, ai etc fueling the fire and not only that but inflation which has been going crazy now sees people looking for more stable asset to hedge against the record high inflation. In fact the CPI number that just came out is still way to high creating a 3.5%+ inflation rate on assets. While that might not sound like a lot you have to remember prior years when we nearly touched 10% and the target is 2% or less.

With this crazy high inflation, increase in wages and printing of money we can see that bitcoin with a steady rate and fix amount could be a good bet to stem off inflation or at least retain value which is what many people seem to be thinking as well.

What are your thoughts? What do you feel is driving the markets the most this bull run?

Posted Using InLeo Alpha