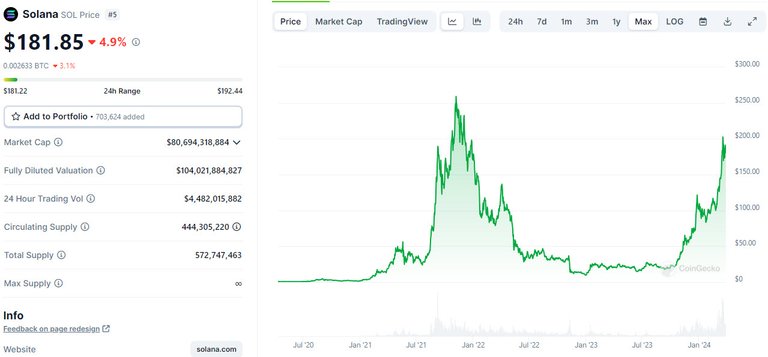

Solana for the last year was a major talking point. From the depths of around $25 during the bear market to it's new ATH in this bull run so far of $200 Solana still hasn't touched it's ATH from the last bull market of $250. That begs the question if we really have seen the top of this bull run or not yet. It seems like in general crypto is in a bit of this holding pattern that needs one of two catalysis to take off or sell off.

That being said Solana has had a rapid rise again and it's on the back of some pretty wild things. Let's take a moment and look at what's driving solana and what we might be able to expect for the rest of this bull run.

*This article is for entertainment purposes only and is not financial advise.

The Meme Frenzy

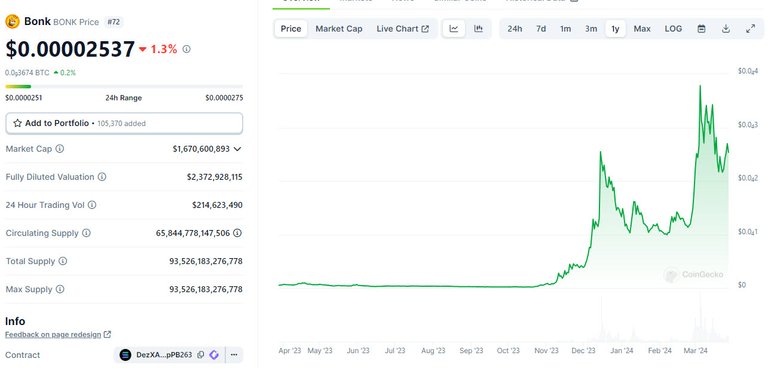

Normally when the meme tokens start to blow up it's time to get the hell out. At least thats what's been shown over the years to be the case. However it seems like meme tokens are in early this time around and kind of have been around forever with no fail point.

Solana had it's own meme coin frenzy with the BONK token. Which well has done rather well.

Solana Possible Holds

Solana has a bit of odd ball things on it which are not for sure. One of them being that it's a primary blockchain for USDC but also that Paxos is joining the Solana blockchain.

With this information we are starting to see that it's very possible that Solana might be being looked at as a much cheaper (in terms of fees) alternative to Ethereum. With that being said Solana might only be at the start of what could be possible for the chain. But let's look further.

Solana Issues

It should go without saying though that Solana has had it's own share of issues. With outages of the blockchain, Binance temp suspends and more Solana is questionable in terms of its stability and is why I put it on the not so great options at the moment for main stream. However that could of course change in the future as the blockchain figures things out.

Falling back on the Meme coin craze we have seen millions being dumped on these meme coins on Solana which has only increased the price. It honestly reminds me of when layer two tokens of Ethereum where a big thing back in 2017 and of which many investors today most likely don't know about and are having their own cycle right here on Solana.

Solana Inflation

Solana has a rather aggressive inflation rate of over 5% of which decreases by 15% year over year until it hits just 1.5% which will be the steady figure moving forward. This inflation rate stated at 8%. Meaning that when Solana is just a little over 10 years old the inflation rate will have already reduced all the way down to 1.5% a rather aggressive decline when you compare it to places like Bitcoin's halving.

It's pretty clear that Sol or Solana has some major issues to overcome. It's why I always say at least at the point we are at today that there wont be a single blockchain that does everything. Instead blockchains will become "leaders" in their niches and depending on the demand and want of that niche will depend on the value of that token because of usage.

Now of course other factors go into this such as tokennomics, how the token was releases, SEC, government, laws etc. and Solana could be primed to face the brunt of that as well depending on how things go with the Ethereum blockchain.

So what are your thoughts on Solana? Why do you like it or dislike it?

Posted Using InLeo Alpha