Are these the only two guarantees in life...death and taxes? I'm not sure on the answer but I'm pretty sure everyone pays tax in one way or another, not just income earners.

Income tax, fringe benefits tax, capital gains tax, fees and tolls, goods and service tax, import and export tax, land tax, value added tax, carbon tax, sales tax, luxury tax, vehicle excise duty, currency transaction tax, fuel excise, stamp duty, property transfer tax, alcohol tax, cigarette tax, gift tax, dividend tax...all taxes found in various countries of the world and all legislated. There's others but I think you get the idea that paying tax is quite unavoidable.

In Australia about half the population pays income tax, just over thirteen million people, and...wait for it folks...the government has announced a tax cut for every single one of them. There's also some changes to the tax-free threshold as well further reducing income tax for some. That's right, a reduction in tax.

I'm not going to go into it all as it can be complicated, but essentially each tax payer will be taxed less (from July 1st 2024) in each pay cycle so they will receive more in their bank account on pay day. It will mean I'll be taxed about $3,300-$4,000 less per year. That's ok right? I mean, even at the lower amount, having $275 extra a month is ok, even though it's not a lot of money in Australia. Having said that, the government will make it up in some other way I'm sure.

The tax-free threshold isn't changing, currently $18,200, which means a person can earn $18,200 AUD in a year and pay no tax. For those outside Australia that's not a lot of money and one couldn't live independently on it, just so you know.

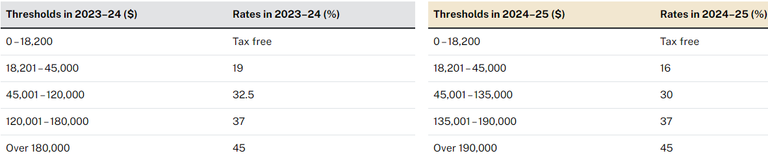

What's changing though, is the tax rate as incomes increase over various ranges above the tax-free threshold.

Below is a chart I lifted from the Australian Tax Office website showing the rates and thresholds.

To explain:

- $0 - $18,200 is tax free

- $18,201 - $45,000 is 16% tax (down from 19%)

- $45,001 - $120,000 is 30% tax (down from 32.5%)

Most Australians are in the $18,201 - $45,000 range but, of course, many earn much more. You'll note the higher income-thresholds have not received tax cuts although those earning at that level will benefit as they push through the lower levels of course.

I'll be honest and say that this tax cut seems a little ineffective considering the rate at which inflation rises and how costly most everyday items are becoming and that's not even considering shrinkflation - the way actual products come with lesser quantities which all have inflated prices.

Food, fuel, insurances, licensing and registration, utilities, goods and services, medical and prescriptions, entertainment, mortgage interest rates...all of these and more have skyrocketed and the tax cuts, while welcome, don't go far in the way of filling the gap; it seems a bandaid-fix designed (probably) for the government to curry favour from voters prior to the inevitable Federal Election. We'll all take it though.

I'll put my tax saving into investments (gold and silver probably) which will make the additional income work harder for me, but many will use it to (try) and plug their financial hemorrhaging, the bleeding out of their incomes, just to stay afloat day to day. (Of course, many are to blame for their own issues through overspending and credit debt, many are not though.)

Like I said, it's a complex issue and I don't want to get into it here but it was worth touching on considering I recently spoke with some people who are really struggling. Will the tax cut help? Yeah, for sure it will, but not enough.

What's it like in your country?

Yeah, I know some of you reading this may look at the figures and think, that's a lot of money, but the truth of it is that due to the cost of living here in Australia it really is not. I wonder what the tax situation in your country is and what your government is, or is not, doing to help its citizens. Feel free to comment and let me know.

Design and create your ideal life, tomorrow isn't promised - galenkp

[Original and AI free]

The money image is my own - The table image is from the ATO as stated above