Welcome to my monthly Hive post. I was looking forward to writing this post. Hive was soaring, the alt season seemed to be in full swing and the world was our oyster. Then along came JP.

https://x.com/CarlBMenger/status/1869684350964613430

I think Carl Menger accurately covered it here. Some of the influencers say December is usually a bad month, but some say we usually get a santa rally, so it's hard to know what we should expect in December. My money was on BULLcember as I am a perma bull but looks like that is not going to happen now.

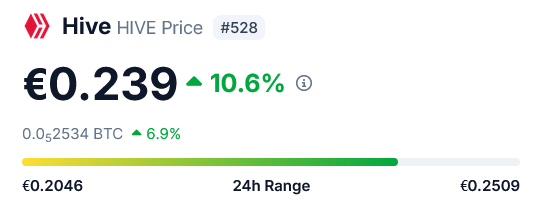

Hive was having a great December after reaching the low of $0,16 in November climbing up to $0,42 in December. Things were looking promising and then JP decided to cancel the santa rally and we have been hit hard, dropping to $0,23 as I type this. That is a 45% drop which is pretty savage.

Since my last post, the price has moved from $0,2404 to $0,2309. It seems like a small dip, but as I mentioned above, it was a wild ride with a massive pump.

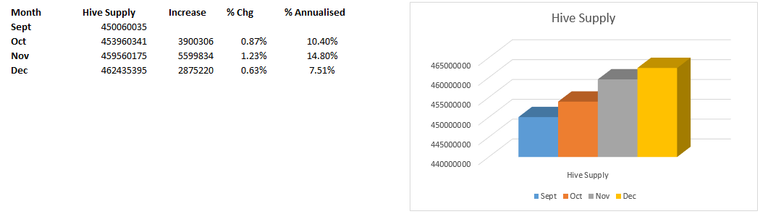

The current supply of Hive stands at 462.43m which is 2.87m higher than last month. This is a lower increase than November where we had nearly 5.6m. The inflation seems to have steadied itself this month. My figures are also just approximation from when I take a snapshot too. I will get the data from HiveSQL once I can pull the data I need easily enough.

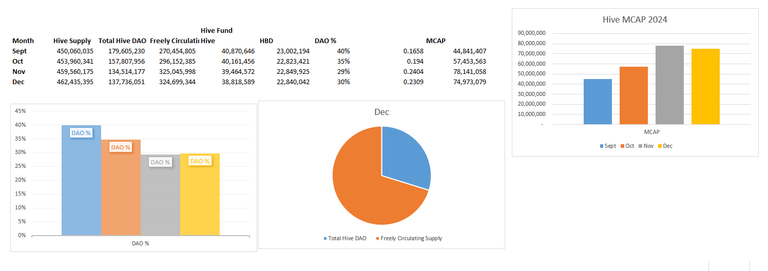

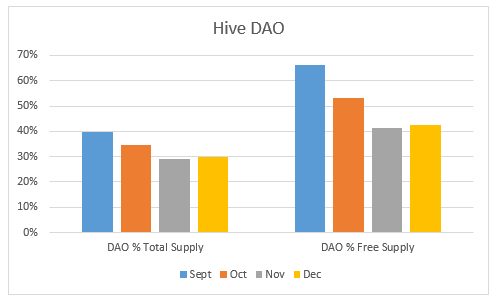

The freely circulating supply is 324.69m. This is basically Hive excluding Hive and HBD (which I converted to Hive) held in the DAO. The DAO's Hive and HBD supply converted to Hive stands at 137.73m Hive. This means that the DAO is currently 42% of the freely circulating supply which is crazy high still but trending in the right direction from the crazy high 66% in September. As a % of the total Hive supply it is down to 30%, which is 10% lower than I recorded in September.

As I have mentioned before, what Hive needs is higher prices to make the amount of HBD in the DAO more manageable or the DAO should burn tokens to a new lower priced Hive reality. For a decentralised chain, it doesn't make sense to have such a huge DAO, especially as Hive has a perpetual DAO, in that it is always increasing.

If you look at the size of the DAO in comparison to the Free Supply %, it is no wonder that Hive stake holders have a huge anvil round their neck supporting this DAO that only until recently was a higher % than Hive stake holders themselves. Things seem to get really critical once the $0,20 level is lost as the debt starts spiraling out of control. As there is no longer a debt ceiling, there is no break mechanism anymore to slow things down if Hive were to dip below $0,12-$0,10 range which would be a huge issue for the tokenomics.

If Hive had kept the higher price in the $0,4x range, we would be in a more safer zone to support the DAO and even the market cap starts moving into much safer zones. Although, this is driven not by the token fundamentals which is a shame.

The Hive market cap has decreased slightly from $78 to $74m which is a shame we are having the market turbulence right now. My market cap figures are lower than you might see other places as I remove the Hive and HBD held by the DAO to get the freely trading Hive and use these when calculating the Market Cap, as this gives a true picture.

HBD & Debt Limit

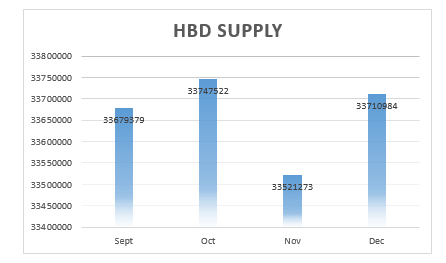

The current supply of HBD is at 33,71m, which is a slight increase over last month of around 200k. We seem to have a stable amount of HBD in the last few months as the chart shows.

The total debt % (HBD divided by Market Cap) is 45%. If we exclude the DAO HBD, even though it is still debt, we get 14.5%. This is quite elevated levels and means that nearly half of the Hive market cap is debt which is not a good or healthy sign for the chain.

Summary

It has been a rollercoaster ride for Hive the last month. General market sentiment has affected Hive too and it hasn't been able to keep the higher prices we have enjoyed. We still have some time left in BULLcember and maybe Hive can be the comeback kid again and get back to higher levels.

Hive Snapshot Date: 20.12.2024

Hive Price : $0,2309

Hive Supply: 462435395

Hive/HBD held in DAO converted to Hive: 137,736,051

Hive DAO: 38,818,589

Hive DAO HBD: 22,840,042

Hive Market Cap: $74,973,079

HBD Supply: 33,710,984

HBD Outside of the DAO: 10,870,942

Debt limit excluding DAO debt: 14,5%

Debt limit all HBD: 45%

Hive data taken from Hive Explorer.

Thanks for reading.

Credits:

Title image created with image source. Top chart taken from Binance. Remaining charts created myself.

Let's connect : mypathtofire

)

)