The day began with a rainy and warm morning, but that didn’t deter me from heading out for my usual jog. The rain was light and refreshing, adding a serene touch to the run as I navigated familiar paths. It’s fascinating how even less-than-ideal weather can become a source of motivation, reminding me that consistency matters more than conditions.

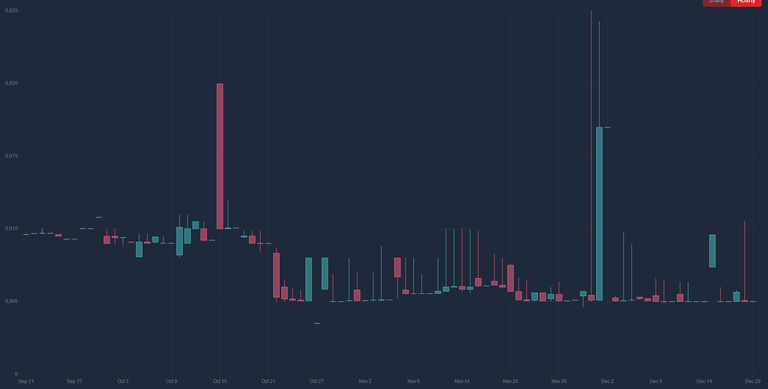

On $HIVE, I noticed that some projects labeled as #dead still have their L2 tokens actively traded, sparking a mix of curiosity and skepticism. Gossip suggests these projects are long gone, but market activity tells a different story, leaving me unsure of what to trust. It’s a reminder of how crypto markets often defy logic, driven by sentiment as much as substance. I spent some time weighing the potential risks and rewards, debating whether to dip in or stay on the sidelines. The contrast between community sentiment and trading data highlights the unpredictable nature of decentralized markets.

The markets were still processing the Fed’s decision to cut rates again, which had a noticeable impact on $HIVE, dropping it back below $0.25.

While this might seem like bad news, it opened up opportunities to consider swaps from $HBD to $HIVE. Such fluctuations often offer more opportunities than setbacks, provided one stays vigilant and strategic. The Fed's influence on crypto markets remains a fascinating dynamic to watch unfold.

In the evening, ALIVE tokens saw a surge in activity, creating an opportunity for traders to fill their bags. I managed to secure some gains during the buzz, which was a satisfying end to the day’s market endeavors.

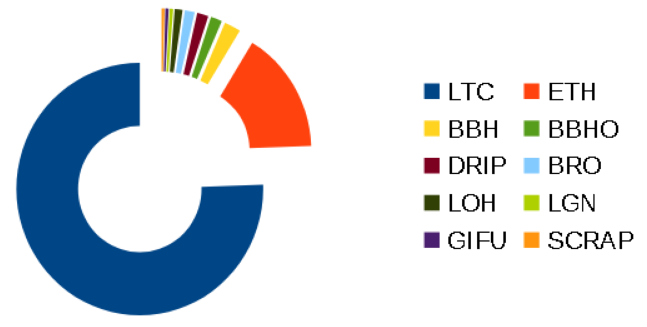

Meanwhile, LTC’s swings settled into a relatively stable range of 403-430 SAT, offering smaller but reliable profit margins. The steady pace of LTC trading was a nice contrast to ALIVE's burst of energy, providing a balanced mix of activity. These moments of volatility and stability keep the trading environment dynamic and engaging. It was another productive day navigating the ever-changing landscape of the markets.

)

)