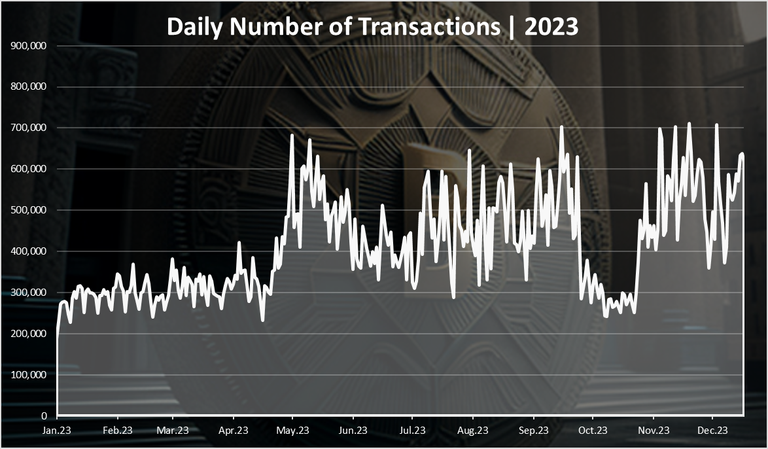

2023 has been the year of inscription on Bitcoin. This was enabled by the Ordinals protocol that first appeared in January 2023, then had its first wave of adoption in March and again now in December 2023. It caused an increase in the number of transactions and activity on chain that increased the fees as well.

The Ordinals protocol enables NFTs and tokens on Bitcoin. Bitcoin NFTs are represented by one satoshi. The smallest Bitcoin denominational unit on Bitcoin. Each satoshi is unique and has its number. The ordinals protocol is used to inscribe a text on the satoshi. This text can be used to generate a low-resolution image. After the Satoshi is inscribed with the text, then it can be transferred buy/sold as an NFT.

It is sufficient to say that NFTs on Bitcoin have caused a lot of controversy as the Bitcoin purist are not a fun of them.

With this said let’s take a look at the Bitcoin network data, and how have these Bitcoin NFTs impacted the network.

We will be looking at:

- Supply

- Active wallets

- Hash rate

- Number of transactions

- Fees

- Miners revenue

The data presented here is mostly gathered from the blockchains charts.

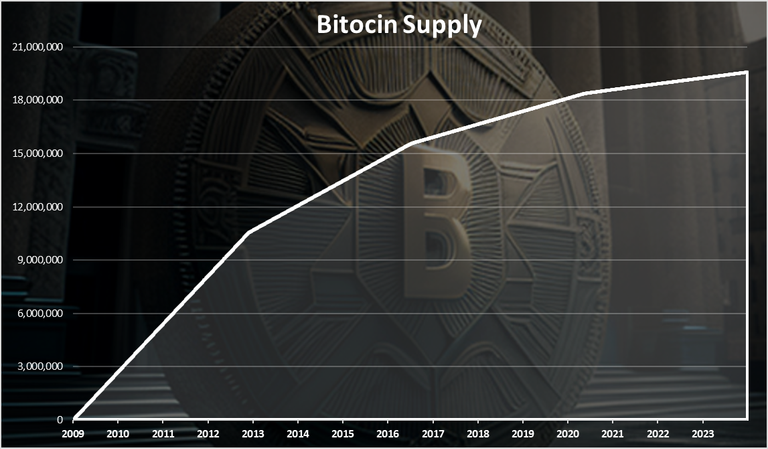

Supply

The one thing Bitcoin is well known for. Its limited supply. There will ever be only 21M coins. Here is the chart with the current supply.

We can notice the breaking points on the chart. This is usually when the halving happens and the emission rate on Bitcoin is reduced. The first Bitcoin halving occurred in 2012 when the reward for mining a block was reduced from 50 to 25 BTC. The halving event in 2016 reduced incentives to 12.5 BTC for each block mined, and as of May 11, 2020, each new block mined only generates 6.25 new BTC.

The next halving is estimated to happen in April 2024 and will further reduce the rewards to 3.125 BTC per block.

At the moment the Bitcoin supply is at 19.57M or more than 93% of the supply is mined.

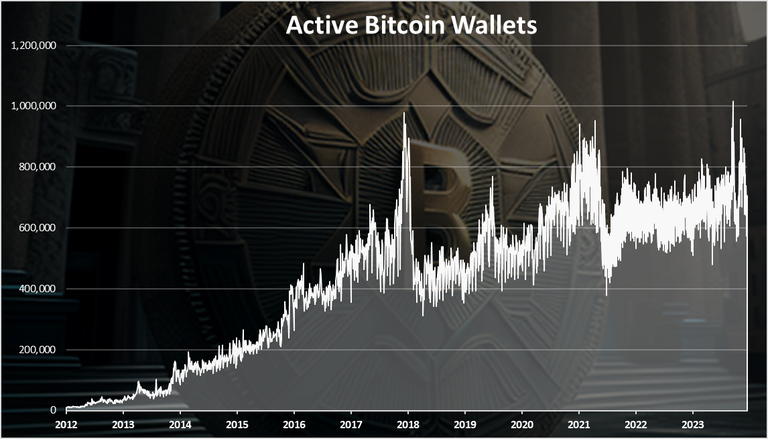

Active wallets

How many of the are being used?

Here is the chart.

The record high numbers for active Bitcoin wallets per day was reached in December 2017 with almost 1M active Bitcoin wallets. A recent ATH in the number of DAUs was reached again in 2023.

When we zoom in 2023 we get this:

A very steady number with around 700k active wallets. The drop in the price didn’t impacted this chart at all.

There has been a recent uptick in the numbers of active wallets going up to 800k for a short period of time.

Interesting that in the last days, when the number of transactions and activity on the chain has increased, the number of active wallets has decreased slightly. This means that some users have been priced out and are not making transactions at the current fees.

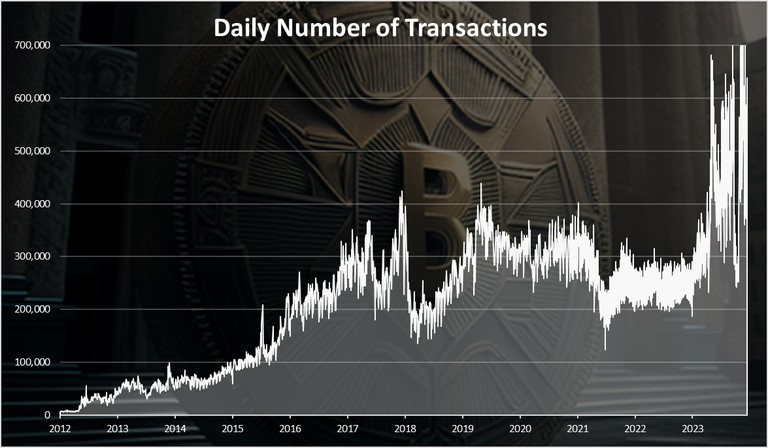

Transactions

The activity on the network is mostly represented by the number of daily transactions.

This is where most of the change in activity is visible on the bitcoin network.

A spike in the number of transactions from under 300k per day to 700k per day in 2023. A new ATH for the number of transactions.

When we zoom in 2022-2023 we get this:

This chart is the most telling about the impact that the Bitcoin NFTs have on the network.

We can see that the increase in the number of transactions reached its peak in May and has slowly going down since then. A sharp drop in October to 300k and recovery again to 700k transactions per day where it is now.

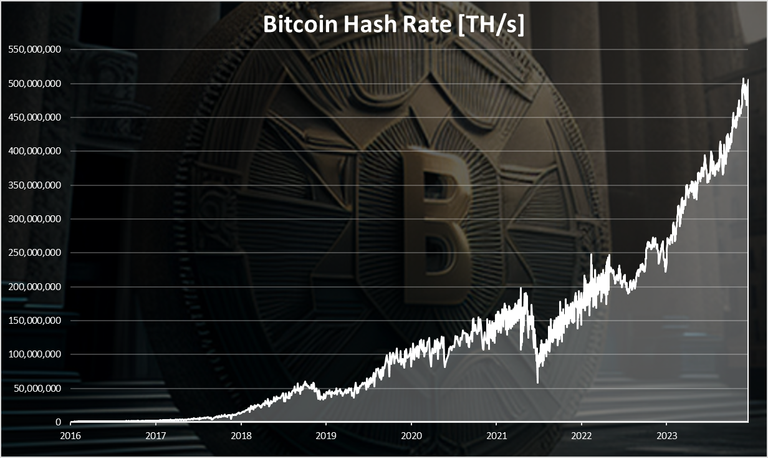

Hash Rate

The ultimate Bitcoin value is the network stability and security. The network security in a proof of work chains is measured in hash rate, or how difficult is to mine. The bigger the completion, the higher the hash rate.

Almost constantly going up with few dips here and there. The most significant dip happened in the summer of 2021 when China banned mining. We can see yet another one just happened recently at the end of 2022, but recovered since then and continue to grow missive to another ATH for the hash rate.

We are now at almost hit 500M TH/s and growing. Some are now using the EXA unit, 500 EXA Hash.

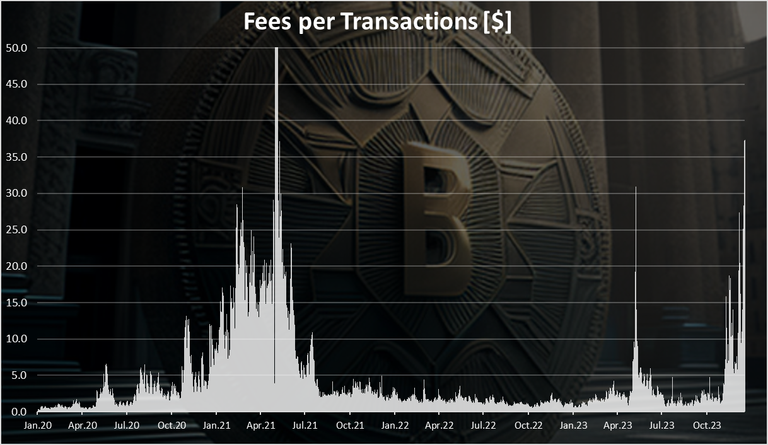

Fees

A bit unpopular topic the fees.

There has been an overall downtrend throughout 2022, and then a huge spike in May 2023. For a few days the fees on the Bitcoin network were above $20 per transaction. A cool down in the summer and now again a spike to more than $30 per transaction. Note that unlike the smart contract chains like Ethereum and all the others, that have different type of transactions, like transferring ETH, transferring other tokens like USDT, executing smart contract action like Uniswap trade, etc. Bitcoin has only one type of transaction and that one is expensive now.

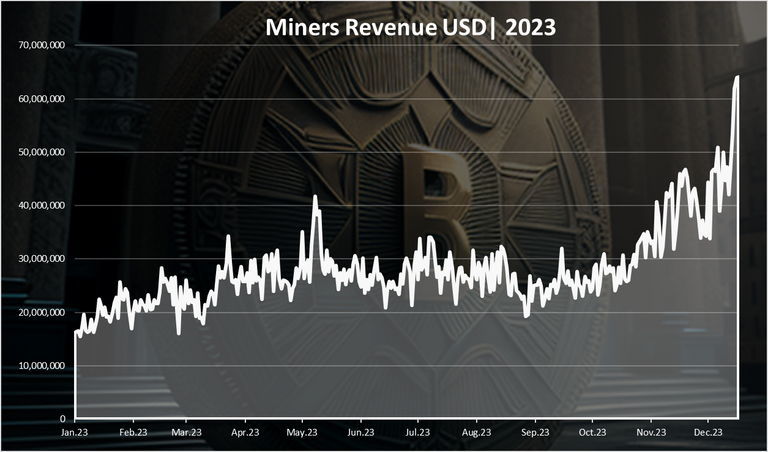

Miners Revenue

Miners are receiving incentives from inflation, or the bitcoin miners rewards per block, but also from the fees users are paying to execute transactions. Whenever there is a bigger demand for transactions the fees are increasing and therefore the miners reward as well. Here is the chart.

Obviously 2023 has been a good year for the Bitcoin miners. The rewards for mining have increased from around 25M to a recent high of 65M USD per day. Will se how long will this hold but the recent spike in activity is paying miners well.

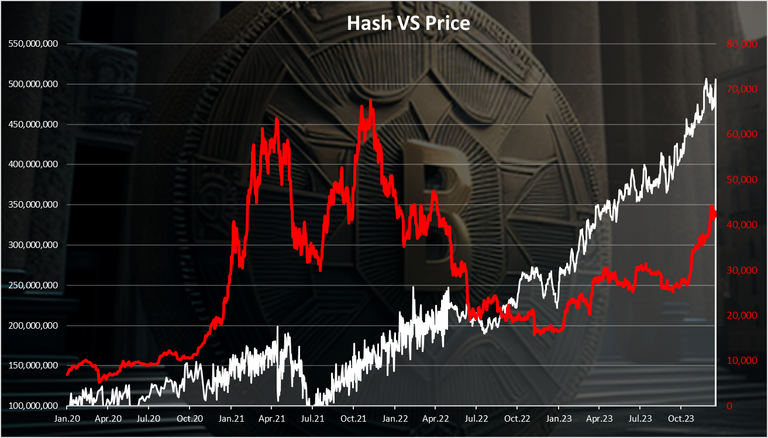

Hash Rate VS Price

When we plot these two together, we get this.

Unlike the price the hash rate has been constantly growing. Although we can notice an obvious correlation, especially back in 2021, when the price increased, shortly after so did the hash rate, but at a lower rate.

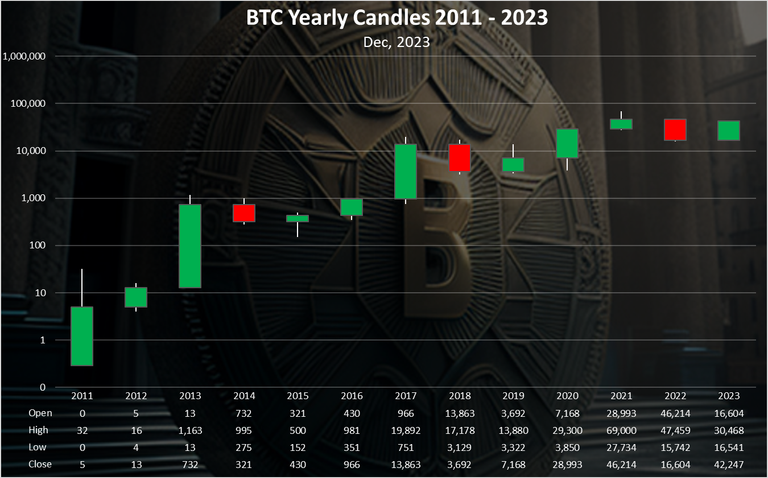

At the end the chart for the Bitcoin yearly candles on logarithmic scale:

Three green ones, one red 😊. 2023 will end a green candle with a start of 16k and end somewhere above 40k. Almost invers of the previous year 2022, that was a red one.

All the best

@dalz