Hive is probably not the most recognised blockchain when it comes to Defi and it's true that we don't have all the lend/borrow, short/long or multiply functions that other platforms provide. However, we have liquidity pools and they are pretty great because they allow you to swap a wide array of tokens.

These liquidity pools on hive-engine are however also an interesting income source for liquidity providers. When you go to tribaldex or beeswap, you can see all the diesel pools in existence. That's how liquidity pools are called on the second layer of hive.

Reward pools linked to diesel pools

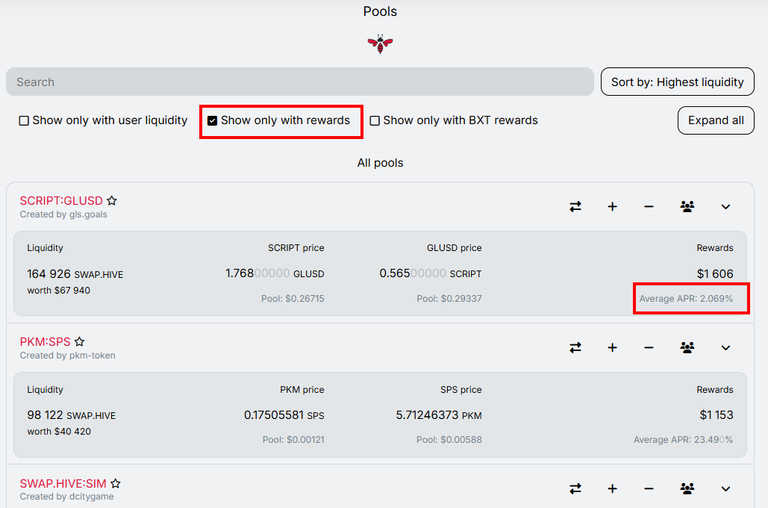

One income source for people providing liquidity are the reward pools that are linked to some of the diesel pools. It's easy to go to beeswap and simply filter the pools so that only pools with rewards are shown. Like that you can see which pools are rewarding the best. You have several options to filter the list.

source: Beeswap

What you have to know about these rewards is that they are provided most of the time by the creators of the pools. It's an incentive to provide liquidity. However there is another income source linked to these diesel pools...

Income from Fees

It's pretty unfortunate that neither platform gives us a precise return from fees. Each swap in the diesel pools costs 0.25% transaction fee that goes to the liquidity providers. The more swaps, the more fees and the more income for liquidity providers. Contrary to the rewards that we spoke about above, the fees are not paid on a daily basis. The fees are added in the form of tokens to your existing liquidity. This means that the fees make your position grow.

How much can you earn from fees?

I was wondering what kind of return could be achieved through fees. On Tribaldex, it's possible to see the accumulated fees expressed in USD during the last 30 days. I made the following calculation to get a return from these fees:

(Fees of last 30 days) X (12 months) / total liquidity in the pool

There are probably more precise ways of calculating the APR. There are many variables that need to be taken into account like the fluctuation of the fees from month to month, the impermanent loss, the quantity of liquidity in the pool. Needless to say that the numbers I have calculated here should be taken with some precautions.

| Pool | Total liquidity | Fees 30 days | Apr in % |

|---|---|---|---|

| swap.hive:sps | 576408 | 4169 | 8.67 |

| swap.hive:swap.btc | 287941 | 3971 | 16.54 |

| swap.hive:dec | 212431 | 3826 | 21.61 |

| swap.hive:swap.ltc | 86767 | 1782 | 24.64 |

| swap.hive:swap.usdt | 52565 | 1059 | 24.17 |

| swap.hive:swap.sol | 29235 | 565 | 23.19 |

What I found interesting from this calculation is that the fees that one could earn for providing liquidity in some of these pools is above 20% APR, which is higher than what you would get from staking HBD...

For some pools you have reward pools and fees that are cumulating their effect and providing a very nice return for liquidity providers.

Are you providing liquidity in diesel pools?

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes: